DComply is your all-in-one solution for Open Banking Compliance. With our Plug-and-Play APIs and intuitive web portal, you can effortlessly integrate your existing systems, securely connect with Third Party Providers (TPPs), and unlock new services to enhance customer experience and drive business growth.

Take the Leap into the Future Today

Unlock unparalleled innovation with

DComply’s Open Banking Solutions.

Take the

Leap into the Future Today

Unlock unparalleled innovation with DComply’s Open Banking Solutions.

BOOK A DEMO

Welcome to DComply –

Seamless Open Banking Compliance

Welcome to DComply –

Seamless Open Banking Compliance

DComply is your all-in-one solution for Open Banking Compliance. With our Plug-and-Play APIs and intuitive web portal, you can effortlessly integrate your existing systems, securely connect with Third Party Providers (TPPs), and unlock new services to enhance customer experience and drive business growth.

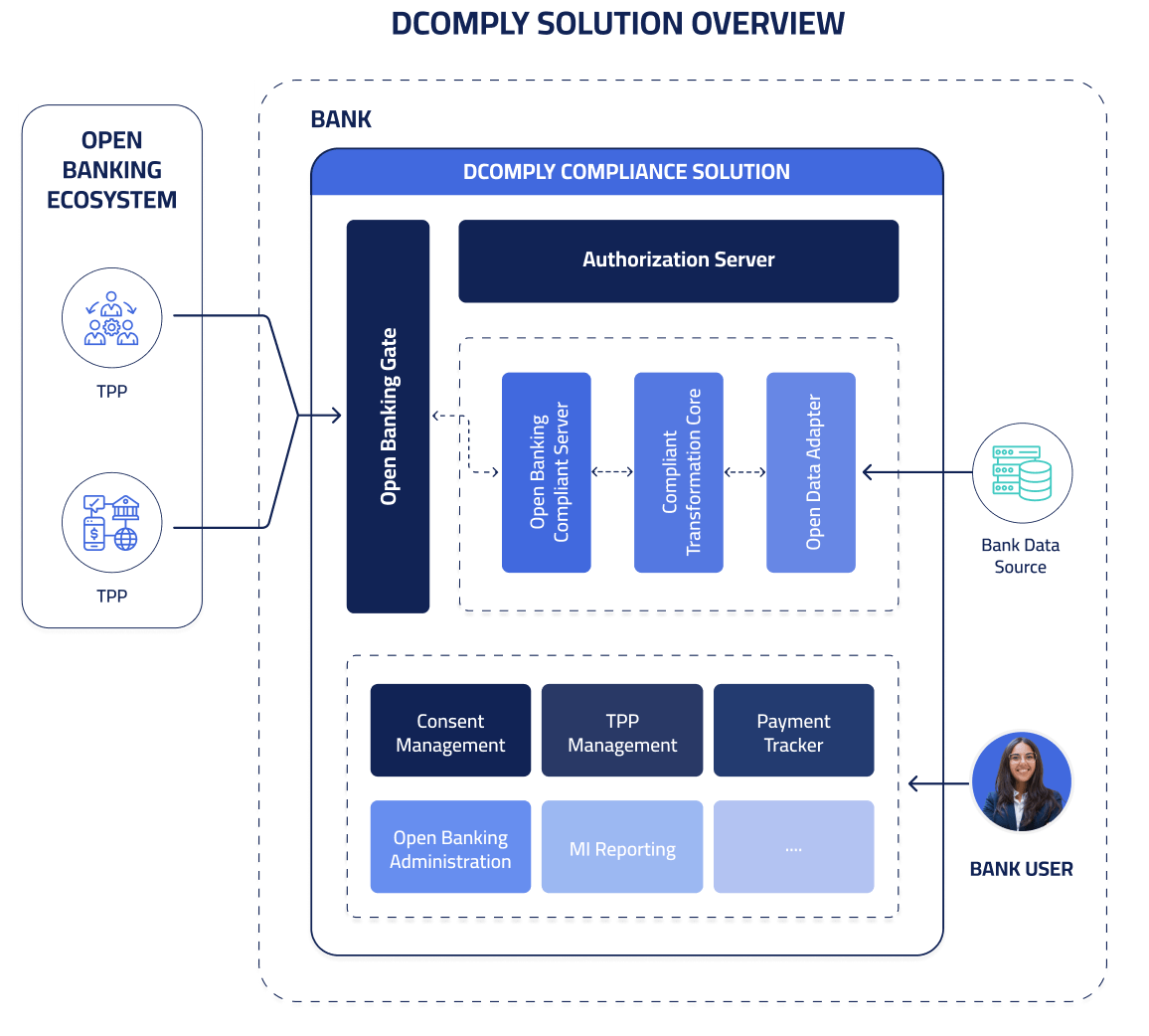

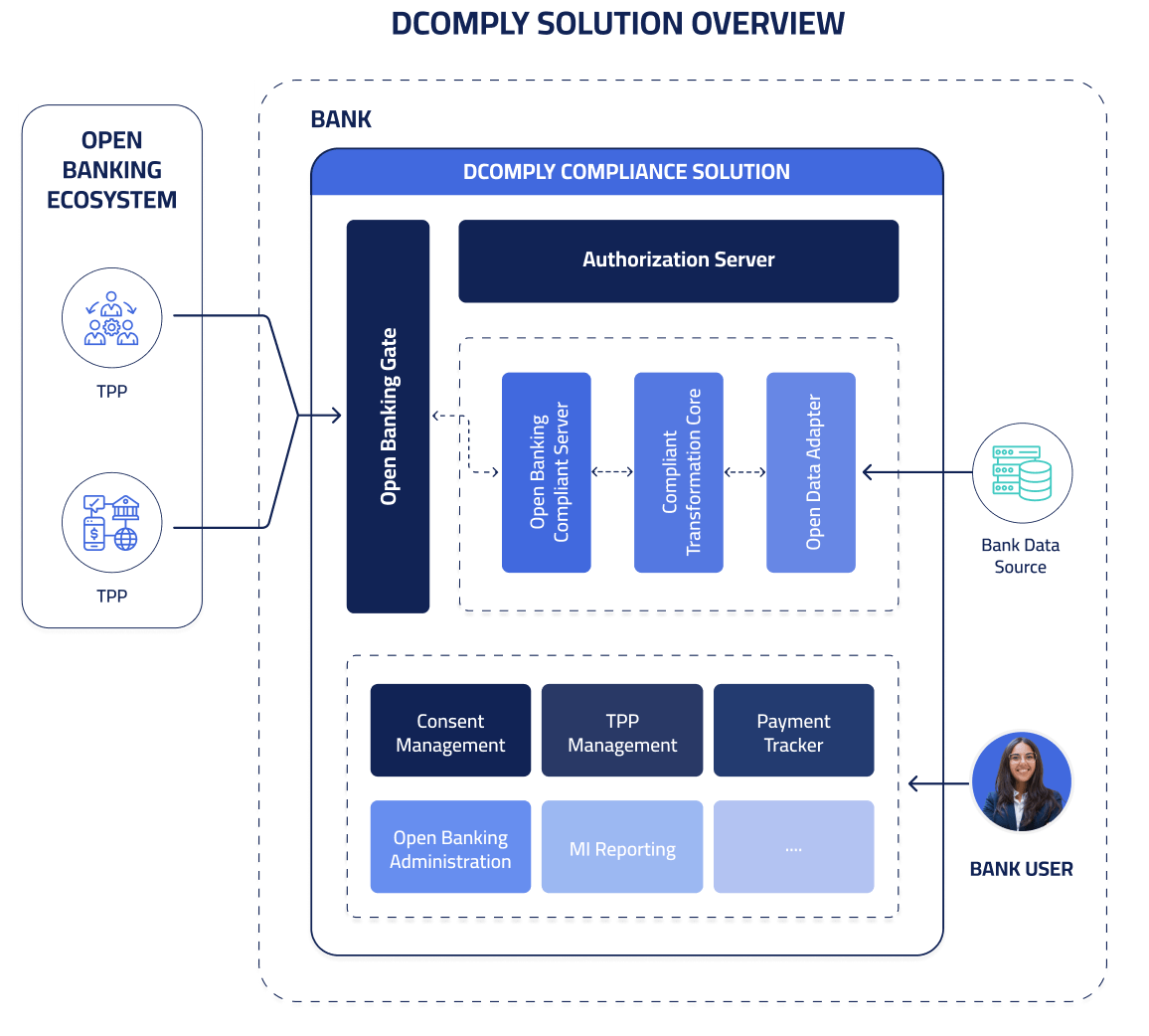

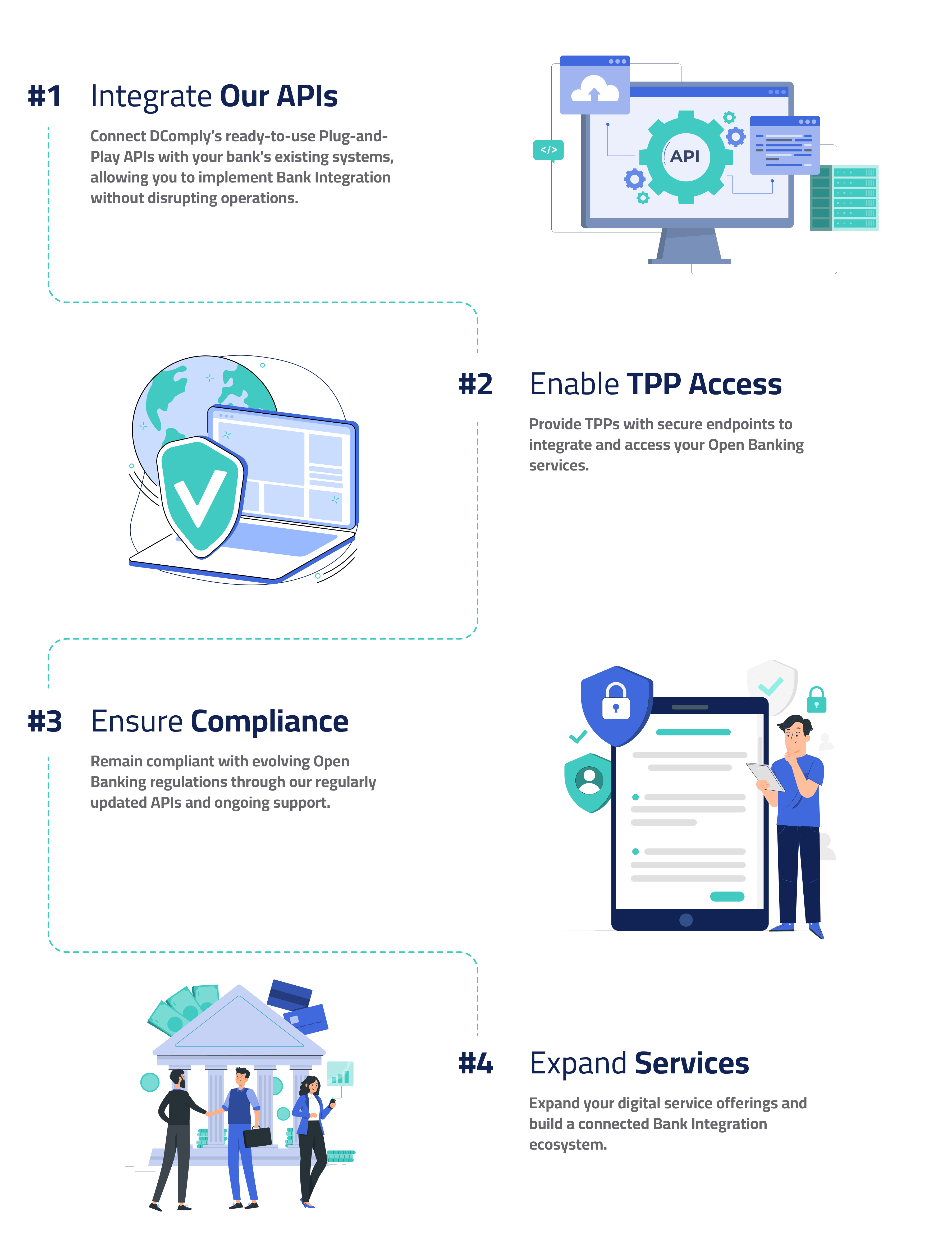

How DComply Works ?

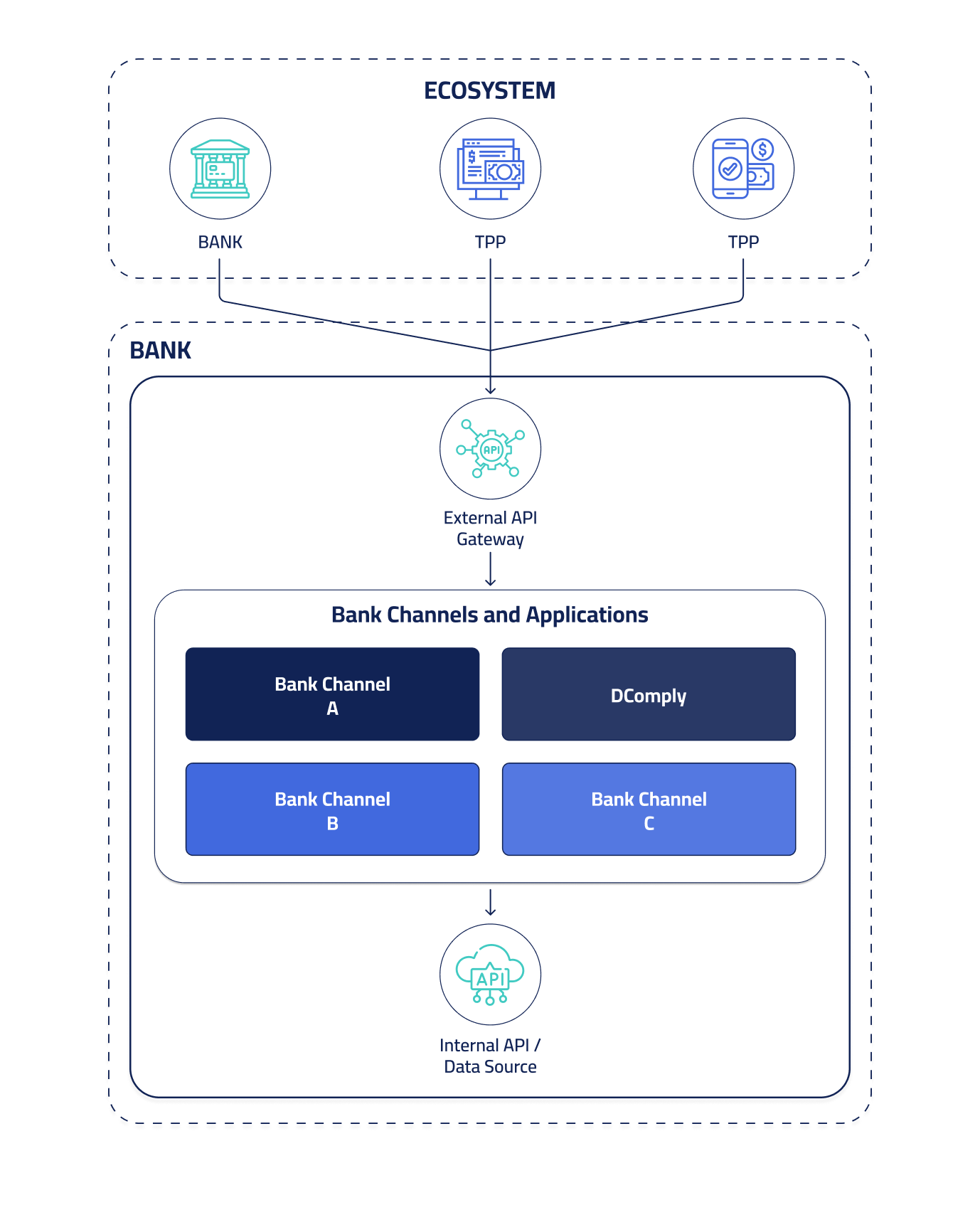

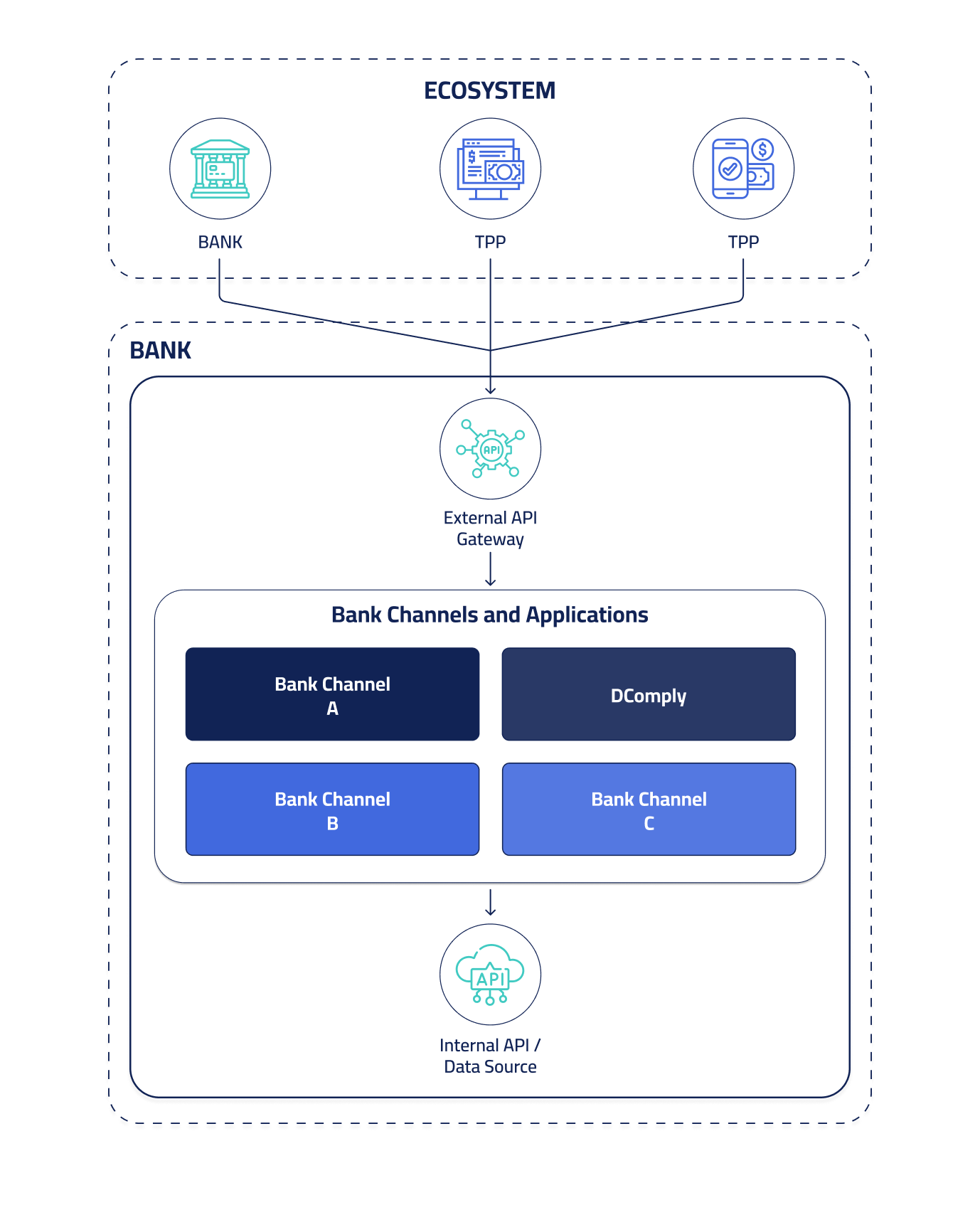

Where DComply

Stands in Your Bank's

Infrastructure

DComply operates within a bank’s infrastructure as part of the bank’s channels and applications, connecting seamlessly through an external API gateway. It enables integration with both internal data sources and external partners in the financial ecosystem.

Where DComply

Stands in Your Bank's

Infrastructure

DComply operates within a bank's infrastructure as part of the bank's channels and applications, connecting seamlessly through an external API gateway. It enables integration with both internal data sources and external partners in the financial ecosystem.

Take full control of your Open Banking operations with

DComply's comprehensive and intuitive portal.

Take full control of your Open Banking operations with

DComply's comprehensive and intuitive portal.

Consent

Management

Facilitate TPPs in creating user consents, guide users through the consent journey, and offer back-office interfaces for bank users to track, search, and export issued consents.

Facilitate TPPs in creating user consents, guide users through the consent journey, and offer back-office interfaces for bank users to track, search, and export issued consents.

TPP

Management

Efficiently manage connected Third-Party Providers with tasks like onboarding new TPPs and editing existing ones, all through a user-friendly application designed for bank back-office users.

Efficiently manage connected Third-Party Providers with tasks like onboarding new TPPs and editing existing ones, all through a user-friendly application designed for bank back-office users.

Payment

Tracker

Monitor the status of Open Banking payments in real-time, export payment data, and generate detailed transaction reports to enhance financial oversight.

Consent

Management

Facilitate TPPs in creating user consents, guide users through the consent journey, and offer back-office interfaces for bank users to track, search, and export issued consents.

Facilitate TPPs in creating user consents, guide users through the consent journey, and offer back-office interfaces for bank users to track, search, and export issued consents.

TPP

Management

Efficiently manage connected Third-Party Providers with tasks like onboarding new TPPs and editing existing ones, all through a user-friendly application designed for bank back-office users.

Efficiently manage connected Third-Party Providers with tasks like onboarding new TPPs and editing existing ones, all through a user-friendly application designed for bank back-office users.

Payment

Tracker

Monitor the status of Open Banking payments in real-time, export payment data, and generate detailed transaction reports to enhance financial oversight.

MI Reporting

Produce standard Management Information reports for Open Banking usage, including all your API key metrics, accessible through intuitive back-office interfaces for data-driven decision-making.

Open Banking Admin Portal

Empower administrators to manage and configure the system effectively, including setting up system adapters and adjusting parameters for optimal performance.

MI Reporting

Produce standard Management Information reports for Open Banking usage, including all your API key metrics, accessible through intuitive back-office interfaces for data-driven decision-making.

Open Banking Admin Portal

Empower administrators to manage and configure the system effectively, including setting up system adapters and adjusting parameters for optimal performance.

Manage and Track All Aspects

of Your Internal Work

User Management

Oversee user accounts with advanced controls, synchronize with identity providers, and ensure top-notch security within a streamlined interface.

Workflow Management

Enhance efficiency by tracking, managing, and refining processes with real-time updates. Delegate tasks, assign responsibilities, and access a comprehensive history of workflow approvals to prioritize requests effectively.

Audit Trail

Maintain transparency and accountability with a powerful audit trail that captures every action—when it happened, who performed it, and what action was taken.

Manage and Track All Aspects

of Your Internal Work

User Management

Oversee user accounts with advanced controls, synchronize with identity providers, and ensure top-notch security within a streamlined interface.

Workflow Management

Enhance efficiency by tracking, managing, and refining processes with real-time updates. Delegate tasks, assign responsibilities, and access a comprehensive history of workflow approvals to prioritize requests effectively.

Audit Trail

Maintain transparency and accountability with a powerful audit trail that captures every action—when it happened, who performed it, and what action was taken.

Why Choose DComply?

Save Time

Meeting compliance requirements can be incredibly time-consuming. That's why we've developed plug-and-play APIs and adapters to fast-track your compliance journey. With DComply, you can integrate quickly without extensive development work, allowing you to focus on serving your customers.

Save Money

Compliance doesn't have to break the bank. By eliminating the need for costly development and reducing operational overhead, DComply helps you save money. Our efficient solutions streamline your processes, so you can allocate resources more effectively and invest in growth opportunities.

Streamline Operations

Our user-friendly web portal simplifies processes for your back-office team. It reduces their workload by providing an easy-to-navigate interface for managing open banking activities, which boosts overall efficiency.

Stay Ahead of Regulations

Regulations in the banking industry are always evolving. DComply is designed to meet all current open banking standards, and we're committed to keeping it updated as regulations change. This means you can rest easy knowing you're always compliant.

Enhance Security

Security is at the heart of everything we do. DComply incorporates Strong Customer Authentication (SCA) to protect customer data and reduce fraud. Additionally, we offer a secure sandbox environment where you can develop and test integrations without any risk to your live systems.

Why Choose DComply?

Save Time

Meeting compliance requirements can be incredibly time-consuming. That's why we've developed plug-and-play APIs and adapters to fast-track your compliance journey. With DComply, you can integrate quickly without extensive development work, allowing you to focus on serving your customers.

Save Money

Compliance doesn't have to break the bank. By eliminating the need for costly development and reducing operational overhead, DComply helps you save money. Our efficient solutions streamline your processes, so you can allocate resources more effectively and invest in growth opportunities.

Streamline Operations

Our user-friendly web portal simplifies processes for your back-office team. It reduces their workload by providing an easy-to-navigate interface for managing open banking activities, which boosts overall efficiency.

Stay Ahead of Regulations

Regulations in the banking industry are always evolving. DComply is designed to meet all current open banking standards, and we're committed to keeping it updated as regulations change. This means you can rest easy knowing you're always compliant.

Enhance Security

Security is at the heart of everything we do. DComply incorporates Strong Customer Authentication (SCA) to protect customer data and reduce fraud. Additionally, we offer a secure sandbox environment where you can develop and test integrations without any risk to your live systems.

5 Countries

Our Open Banking platform is currently in compliance with various regional regulations and expanding, including:

Kuwait

(CBK Sandbox Regulations)

KSA

(SAMA Regulations)

UAE

(UK OBL Framework)

Jordan

(Jordan Open Finance Standard)

Bahrain

(CBB Regulations)

5 Countries

Our Open Banking platform is currently in compliance with various regional regulations and expanding, including:

Kuwait

(CBK Sandbox Regulations)

KSA

(SAMA Regulations)

UAE

(UK OBL Framework)

Jordan

(Jordan Open Finance Standard)

Bahrain

(CBB Regulations)

Take the Leap into

the Future Today

Equip your bank with the tools needed to thrive in the modern financial landscape. Contact us to learn how our solution can simplify your path to open banking compliance

Take the Leap into

the Future Today

Equip your bank with the tools needed to thrive in the modern financial landscape. Contact us to learn how our solution can simplify your path to open banking compliance